In the complex world of personal finance, one term stands out as a key player in determining financial success: Credit Scores. These three-digit numbers wield significant power, influencing everything from loan approvals to employment opportunities. In this article, we’ll delve into the intricacies of credit scores, exploring their components, understanding score ranges, and unlocking the strategies to boost them.

One of the primary factors influencing your credit score is your payment history. Timely payments on credit accounts, such as loans and credit cards, contribute positively to your score.

Credit utilization, the ratio of your credit card balances to credit limits, is another crucial component. Keeping this ratio low demonstrates responsible credit management.

The length of your credit history matters. Lenders prefer borrowers with a longer credit history, as it provides more data to assess creditworthiness.

The variety of credit accounts you have impacts your score. A mix of credit types, such as credit cards, installment loans, and mortgages, can be beneficial.

Opening multiple new credit accounts in a short period can negatively impact your credit score. Lenders may view this as a sign of financial instability.

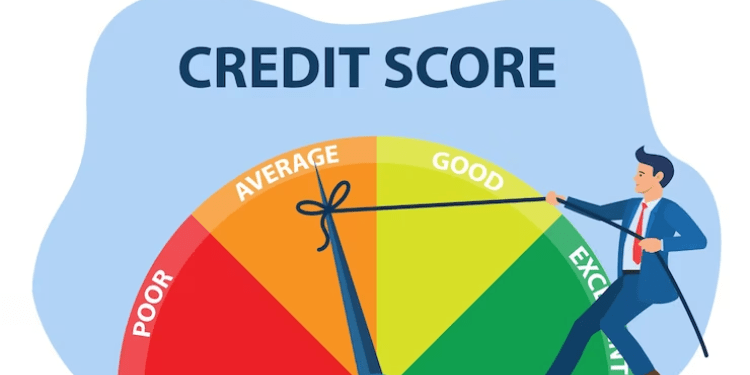

An excellent credit score (usually above 800) indicates a history of responsible credit management. Borrowers with excellent credit enjoy the best interest rates and terms.

A good credit score (around 700-799) suggests solid financial habits. While not in the excellent range, borrowers with good credit still qualify for favorable terms.

Fair credit (around 600-699) may limit options, but borrowers can still access credit. Interest rates might be higher, reflecting a moderate level of risk.

Poor credit (below 600) presents challenges in obtaining credit. Borrowers with poor credit may need to explore alternative options or work on improving their scores.

Consistently making payments on time is the most effective way to positively impact your credit score. Late payments can have a lasting negative effect.

High levels of debt relative to income can negatively impact your credit score. Lenders assess your ability to manage existing debt before extending more credit.

Each time you apply for credit, a hard inquiry is made on your credit report. Multiple inquiries in a short period may raise concerns for lenders.

A diverse mix of credit accounts, such as credit cards, installment loans, and mortgages, contributes positively to your credit score.

The simplest and most effective strategy is to pay your bills on time. Set up reminders or automatic payments to avoid late payments.

High credit card balances relative to credit limits can harm your credit score. Focus on reducing balances to improve your score.

Regularly monitoring your credit report allows you to catch errors or fraudulent activity early. Reporting discrepancies promptly is crucial.

While new credit can be beneficial, opening too many accounts in a short period can signal financial instability. Be strategic in your credit applications.

Lenders use credit scores to assess the risk of lending money. Higher credit scores lead to lower interest rates on loans and mortgages.

Credit card issuers evaluate credit scores to determine eligibility and credit limits for card applicants.

Some employers review credit scores as part of the hiring process, especially for positions involving financial responsibilities.

Contrary to popular belief, closing credit card accounts can negatively impact your credit score. It may reduce your overall credit limit, increasing your credit utilization ratio.

Checking your own credit report, known as a soft inquiry, does not harm your credit score. Only hard inquiries, initiated by lenders during credit applications, have an impact.

Regularly monitoring your credit allows you to detect and rectify errors promptly, safeguarding your financial reputation.

If you spot inaccuracies on your credit report, take immediate action. Dispute the errors with the credit reporting agencies to ensure a clean and accurate report.

Individuals with no credit history can start building credit with secured credit cards. These require a security deposit and act as a stepping stone to unsecured credit.

Credit-builder loans are designed to help individuals establish credit. These loans hold the borrowed funds in a savings account, gradually building credit as repayments are made.

Start building credit responsibly during college by using a student credit card and making timely payments.

As you enter the workforce, focus on maintaining good credit habits to secure financial stability.

Teach children about responsible credit use and manage family finances wisely to set a positive example.

Even in retirement, maintaining good credit is essential for financial flexibility and peace of mind.

The economic challenges brought by the pandemic have affected credit scores for many. Seek assistance and explore relief options if needed.

Temporary relief measures, such as forbearance on loans, may impact credit scores. Understand the implications and communicate with lenders proactively.

The future of credit scoring may involve the inclusion of alternative data, such as rent and utility payments, to provide a more holistic view of an individual’s creditworthiness.

Artificial intelligence is poised to play a larger role in credit scoring, offering more accurate and dynamic assessments based on vast datasets.

Credit counseling services provide valuable guidance on managing debt, improving credit, and achieving financial goals.

Explore reputable credit counseling services to gain insights into your financial situation and receive personalized advice.

Understanding and managing your credit score is fundamental to financial success. From the components that make up your score to the strategies for improvement, every aspect plays a crucial role.

Take charge of your financial future by embracing responsible credit management. Your credit score is a reflection of your financial habits and decisions.