As we reflect on the events of 2023, global equity markets stand out with significant success, showcasing impressive performance. Simultaneously, commodities, including gold and others, witness robust returns. This retrospective sets the stage for anticipating 2024, a year that poses potential challenges for equity returns while signaling continued ascent for gold and bonds.

Delving into the intricacies of equity underperformance, multiple factors come to the forefront: higher interest rates, mounting US debt levels, credit rating downgrades, weakened consumption, growing concerns of credit card delinquencies, and diminished corporate earnings. These elements may culminate in a correction in equities, potentially leading to stringent lending conditions in H2 of 2024.

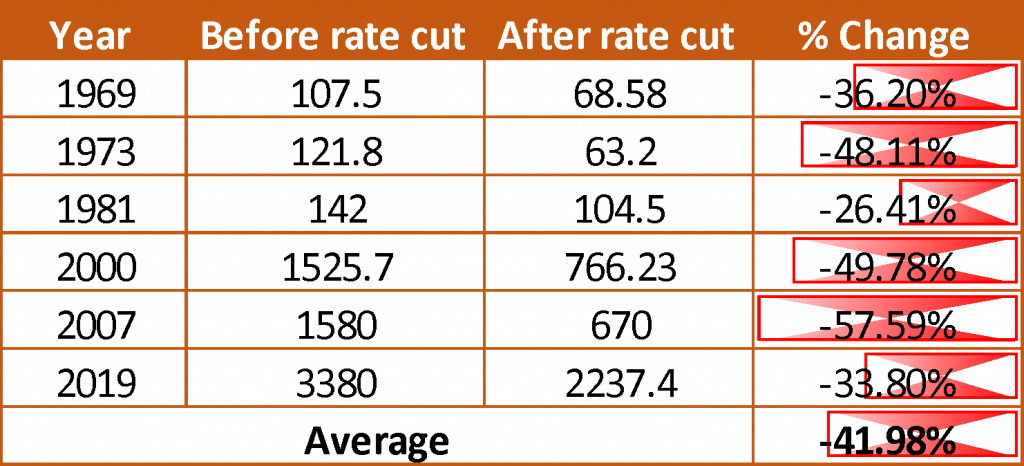

Examining a 50-year history, a discernible correlation emerges between equity market downturns and Federal Reserve (FED) rate cuts. The S&P 500’s reaction to FED rate cuts historically averages a 41% decline. The impending downturn in the US equity market amplifies the likelihood of underperformance in other emerging and Asian markets. Projections hint at an anticipated rate cut during the March-April meetings, suggesting potential negative returns for equities in the latter half of the year.

Recent negative US data releases contribute to rising rate expectations, exerting pressure on the DXY. The US treasury surpassing the $34 trillion mark on December 31, 2023, marks a historic milestone driven by substantial borrowing during both President Donald Trump’s and President Joe Biden’s administrations. While aimed at economic stabilization and recovery, this recovery triggers increased inflation, prompting higher interest rates and elevated government debt management costs. The long-term concern lies in the potential risks associated with continually escalating debt levels.

Contrary to global equities’ potential underperformance, Indian equities could outshine the global market. Historical data from the past two General Elections (2014 and 2019) indicates substantial inflows before the election, raising expectations for a potential third consecutive win for the ruling government. Such an outcome might attract flows, mitigating policy shift risks and potentially strengthening the Rupee.

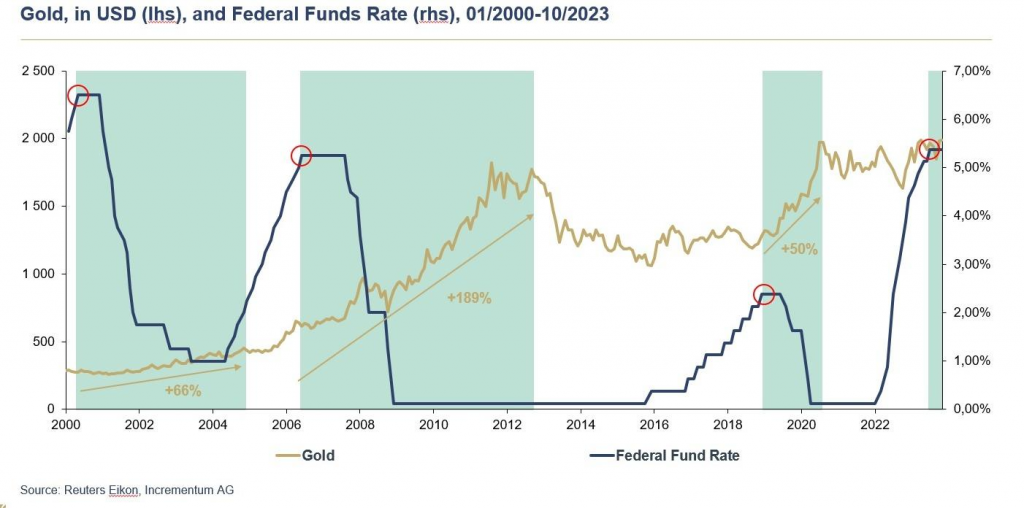

As equities face the prospect of underperformance, attention turns to the future of gold. Gold is poised for outperformance, especially when central banks signal rate cuts, reflecting concerns about economic growth. Investors, wary of a potential recession, typically reassess their portfolios in response to these signals, making adjustments to manage their risk exposure.

Analyzing the presented chart reveals a consistent trend: whenever the FED opts for a rate cut, there is a concurrent appreciation in the price of gold by at least 50%. Anticipating a forthcoming rate cut by the FED in the second quarter of 2024, it is plausible to expect a corresponding increase in the gold price.