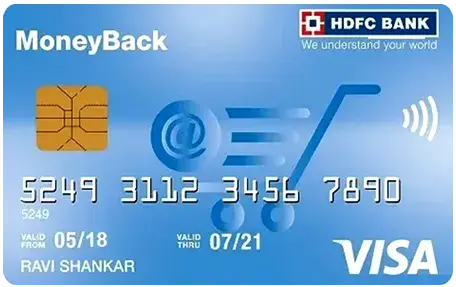

HDFC MoneyBack Credit Card is a super-saver card which gives you instant cashbacks on every single spend. With the MoneyBack credit card, earn attractive rewards on each transaction, fuel surcharge waiver, welcome benefit of 500 cash points, Rs. 500 worth gift voucher on spending Rs. 50,000 or above every year, and much more. The card comes with a joining and renewal membership fee of Rs. 500 plus applicable taxes.

On Hdfc Bank Website

Updated: 08-05-2024 05:06:31 PM

| Annual fee | HDFC MoneyBack Platinum credit card comes with Zero lost card liability on reporting card loss immediately to HDFC’s 24-hour call centre. |

| Reward | Attractive HDFC MoneyBack credit card reward points on each transaction. |

| Benefits | The HDFC Bank Money Back credit card is enabled for contactless payments, facilitating fast, convenient & secure payments at retail outlets. |

Following are the HDFC MoneyBack credit card benefits and features in detail:

Welcome Benefit

Rewards

Following are the HDFC MoneyBack credit card charges:

Following are the eligibility criteria for HDFC MoneyBack Credit Card:

Eligibility for Salaried:

Eligibility for Self-employed:

If you want HDFC MoneyBack Credit Card apply online with the following documents:

If you want to avail of the HDFC Business MoneyBack credit card benefits, apply for the card online through our website by following the steps mentioned below:

Apart from MoneyBack Credit Card, HDFC Bank offers the following credit cards:

Get exclusive rewards, offers, & cashback benefits. Compare & choose a best suited credit card as per your need and apply online!

HDFC MoneyBack Credit Card limit varies for each applicant and is determined based on their income range and credit score. However, the maximum limit you can expect for the MoneyBack credit card is up to Rs. 1.5 to Rs. 2 Lakhs while the minimum is Rs. 25,000.

At present, the HDFC MoneyBack credit card does not provide any movie offer.

Yes, you can withdraw cash from HDFC MoneyBack credit card at any ATM. However, this facility comes at a charge of 2.5% of withdrawn amount or Rs. 500, whichever is higher.

You can HDFC MoneyBack credit card statement online through any of the following methods:

• Via Net Banking

o Visit the official website of HDFC Bank and then log in to your net banking account.

o Click on the ‘Cards’ tab and select ‘Enquire’ option.

o Now click on the ‘View Statement’.

o Select the credit card and the period for which you want the statement.

o Click on ‘View’ and then click on ‘Click to View/Download’.

• Via the Mobile App

o Download the mobile app of HDFC Bank and log in to your account.

o Choose ‘Credit Card’.

o Select the ‘Download Billed Statement’ option.

o Choose the period for which you want the statement.

HDFC MoneyBack credit card comes with a joining and renewal membership sees of Rs. 500 + applicable taxes.