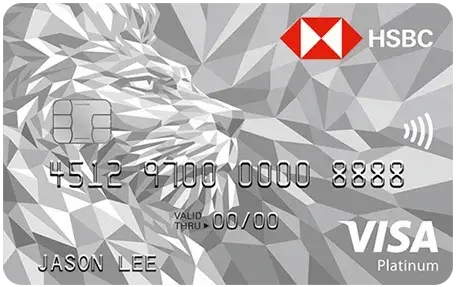

The HSBC Visa Platinum Credit Card offers you unmatched rewards and offers, with instant recognition and exclusive privileges. One of the best features of the card is that it is a lifetime free credit card that comes with ZERO joining and annual fees. And also you can get offer of Rs 1000 cashback voucher*.

On HSBC Website

Updated: 08-05-2024 02:40:05 PM

| Best for | Rewards & Travel |

| Joining fee | 0 |

| Annual fee | 0 |

| Rewards | 5X rewards on subsequent purchases made after spending Rs. 4,00,000 (maximum 15000 accelerated reward points) in an anniversary year |

| Annual income required | Minimum Rs. 4,00,000 per annum (for salaried individuals) |

| Required age | 18 to 65 years |

Following are the main HSBC Visa Platinum Credit Card benefits and features:

Joining Benefit

Introductory Offers

Other Benefits

Partner Offers

Joining & Annual Fees

One of the best HSBC Platinum credit card benefits is that it is free for a lifetime.

Other Benefits

Following are the fees and charges levied on the HSBC Platinum card:

You can apply for an HSBC Visa Platinum credit card on meeting the following eligibility criteria:

You will need to submit the following documents to apply for an HSBC Visa Platinum Card along with the filled-in and signed application form:

*The above list of documents is for only reference purposes. The bank may ask for additional documents during the process of credit card application.

You can apply for an HSBC Visa Platinum Credit Card through Banking Vidhya.

Apply for HSBC credit cards and enjoy various privileges like lounge access, 10X reward points, cashback, and many more.

Your HSBC Visa Platinum Card’s credit limit is decided at the discretion of the bank. The HSBC Bank conducts thorough checks before assigning a specific limit to each customer. Some key factors that play a major role in deciding your credit card limit are your credit score, credit report, and previous/existing debt repayment habits.

es, you can use this card for foreign transactions without any extra charges. However, the bank will levy an applicable currency conversion rate in the country where you make the transaction.

Yes, the card offers 5X (5 times) rewards on subsequent purchases made after exceeding Rs. 4,00,000, with a maximum of 15,000 accelerated reward points in an anniversary year.

Yes, you can win an Amazon e-gift voucher valued at Rs. 250 on completion of the online credit card application and Video KYC. You also get the chance to avail of the following introductory offers: