Public Sector Banks Rally Up to ten%

Shares of public area banks (PSBs) soared up to 10% at the BSE on Monday, persevering with their upward fashion from the previous week. This rally followed the Reserve Bank of India’s (RBI) statement of a document Rs 2.1 trillion surplus switch to the vital government for the fiscal year 2023-24 (FY2024).

Key Movers in the Market

In Monday’s intraday trading, Indian Overseas Bank (IOB), Uco Bank, and Punjab and Sind Bank saw significant gains, rallying between 5% and 10% on the National Stock Exchange (NSE). Other banks, inclusive of Central Bank of India, Bank of Maharashtra, Punjab National Bank, Union Bank of India, and Indian Bank, additionally skilled will increase, starting from 2% to four%.

By 2:10 PM, the Nifty PSU Bank index, leading among sectoral indices, rose with the aid of 1.6%, outperforming the Nifty 50, which went up by using 0.Five%. Financial indices just like the Nifty Bank, Nifty Financial Services, and Nifty Private Bank index every received 1.3%.

Performance Over Recent Days

Over the past 3 days, the Nifty PSU Bank index has risen by using three. Four, outpacing the Nifty 50’s 2.3% boom. In the ultimate 10 trading days, the PSU index preferred with the aid of 7.1%, as compared to a 4.6% advantage within the benchmark index. The Nifty PSU Bank index hit a file high of 7,685.Ninety-five on April 30, 2024.

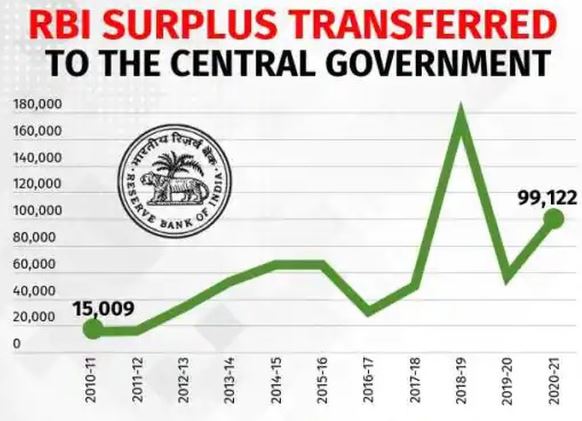

Impact of RBI’s Surplus Transfer

The RBI’s surplus switch of Rs 2.1 trillion exceeded each the FY2025 Budget Estimate (BE) of Rs eighty,000 crore and market expectations of Rs 1.Zero-1.2 trillion. The extra Rs 1.3 trillion over the FY2025BE represents about 0.4% of GDP. While there can be shortfalls in divestment and telecom receipts, the excess transfer aids monetary consolidation, making the authorities’s target of lowering the gross monetary deficit to GDP (GFD/GDP) ratio to 4.Five% by using FY2026 extra plausible, according to analysts at Kotak Securities.

Fiscal Outlook and Market Dynamics

Kotak Securities anticipates that the government’s comfortable fiscal role and surplus coins balances will facilitate in addition buybacks, reducing net G-sec delivery and enhancing demand-supply dynamics. They expect liquidity situations to improve in the 2nd region of FY25 because of accelerated authority spending, seasonal forex payback, and the ability of RBI interventions to manipulate FPI debt flow.

Domestic conditions are favorable for a bond rally, however, the brokerage remains cautious about possible foreign exchange intervention sterilization and global yield will increase, especially with capacity delays in the US Fed price cycle. Higher-than-budgeted inflows ought to be useful resource monetary consolidation or enhance capital expenditure. Any G-sec yield decline amid economic prudence is anticipated to benefit the treasury income of banks, mainly PSBs mentioned in ICICI Securities.

Individual Stock Performances

IOB surged 10% to Rs seventy-four in intraday alternate on good sized volumes, with the common trading extent almost tenfold, as 95.12 million shares changed arms at the NSE and BSE. Uco Bank jumped 8% to Rs 61.40, pushed by a —-fold boom in average trading volume, with 55.37 million stocks traded at the NSE and BSE.

Industry Outlook

Uco Bank’s FY24 annual document highlighted declining inflation and softening global commodity costs as factors decreasing import prices. With exports turning superb and measures to substitute imports and boom capital inflows, dealing with the cutting-edge account deficit is anticipated to be less difficult this year. Industrial growth trends are also encouraging.

The Indian banking region is on an upward trajectory, strengthened by a strong economic boom, rising disposable incomes, growing consumerism, and easier credit scores to get the right of entry. Digital price methods have surged in recent years, with technological improvements considerably enhancing performance, productivity, niceness, inclusion, and competitiveness in monetary services, mainly virtual lending.

Looking in advance, credit score increase is expected to be mild in FY25, even as deposit increase is probably to improve as banks cognizance on expanding their liability franchises. Interest unfold compression may additionally strain profitability, even though it is predicted to remain healthful. Asset high-quality is anticipated to keep improving, and the banking zone’s capital position is projected to live comfortably within the near time period, consistent with Indian Bank’s FY24 annual report.