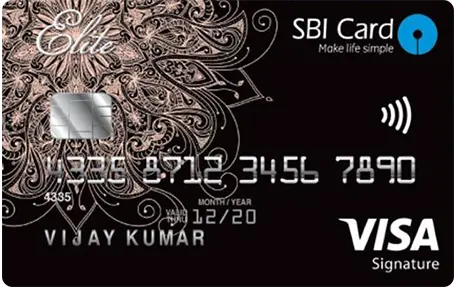

SBI ELITE Credit Card is a ticket to premium lifestyle. An absolute traveler's delight with 8 complimentary visits to international & domestic Airport Lounges in a calendar year, enjoy low Forex Mark-up, exclusive concierge, club Vistara membership, Trident Privilege & a lot more!

On SBI Card Website

Welcome gift:

Welcome e-gift voucher of 5,000 for spending at premium brands such as Yatra, Marks & Spencer, Hush Puppies/Bata, Pantaloons, and Shoppers Stop.

Complimentary movie tickets:

Free Movie Tickets every year worth 6,000 (valid for at least 2 movie tickets per booking per month, maximum discount that can be availed is 250 per ticket for 2 tickets only, excluding convenience fee).

Milestone Privileges:

ELITE Rewards

KYC fulfillment: Passport/ Voter’s ID Card/ Driving Licence/ Aadhaar Letter or Card/NREGA Card/PAN Card

Address proof: Utility Bills/ Ration Card/ Passport

ID proof: Aadhar Card/ PAN card/ Driving license/ Voter Id Card

Income Proof: Last 3 Salary slips / bank statements

Photographs

Joining Fees: Rs 4999 + Taxes (Welcome gift worth Rs. 5,000)

Annual Fees: Rs 4999 + Taxes

Fuel Waiver

Enjoy 1% Waive off on Fuel Surcharge across all petrol pumps. (Govt. Service Tax extra as applicable). Maximum Surcharge Waiver of 250 per month per credit account.

International Lounge Program

Terms and Conditions:

Domestic Lounge Program

2 complimentary visits to Domestic Airport Lounges every quarter in India. To use the offer, use your card at the respective lounges. It is a limited offer and comes to by Visa /MasterCard. Check out the list of participating lounges on SBI Card website.

Club Vistara Membership

Trident Privilege Membership

Lowest Forex Markup

SBI Card ELITE comes with the lowest Foreign Currency Mark-up Charge, i.e., 1.99% on International usage. The car member also gets 2 Reward Points on spending every 100 on International transactions.

Exclusive Concierge Service

Assistance with gift delivery, movie and hotel reservations, customized holiday packages, and so on. You can request Concierge Services by calling at 022-42320257 or writing a request at sbicardelite@aspirelifestyles.com

To earn max rewards & redeem cashback, value back offers, discounts & exclusive deals. Select the best Credit Card as per need.

SBI Card ELITE is a Credit Card powered by Visa payWave/ MasterCard Contactless feature. This card is enabled with a secure and contactless chip technology which helps you pay for your everyday purchases in the most convenient and fastest way.

FLEXIPAY is SBI’s easy installment plan that enables you to buy anything and repay in EMIs. You can call SBI Card’s helpline or book online on www.sbicard.com to avail this facility, within 30 days of your purchase.

Through this facility by SBI, you can easily avail a cheque any time at your doorstep. All you need to do is call SBI Card Helpline. By using Easy Money facility, you can avail money against your cash limit. The availed money can be used for holiday, buying a TV, or for your other needs. The cheque can be availed for a minimum of 5,000 and maximum of up to 75% of your available SBI Credit Card Cash Limit. You will also have to bear the applicable Processing Fee.

There are following 14 ways to make your SBI Credit Card payment:

When you approach any bank or financial institution for credit, they will evaluate your application on the basis of your credit information report, which includes your existing credit lines, past payment history, income, and other factors. If you have a good past payment history, you may get credit faster and on better terms. A poor past payment record may result in the denial of credit or expensive credit deal. Therefore, good financial discipline and prudent credit management is essential to ensure a good credit history.

Yes, you can improve your credit record by following these tips: