Navigating Home Loan Interest Rates: A Comprehensive Guide

In the realm of property acquisition, one of the pivotal considerations is securing a suitable home loan with favorable interest rates. Understanding the nuances of interest rate structures offered by various financial institutions is crucial for making informed decisions.

Delving into Interest Rate Dynamics

Before delving into the specifics of interest rates, it’s imperative to grasp the fundamental principles governing them. Interest rates represent the cost of borrowing money and play a pivotal role in determining the overall affordability of a home loan.

Exploring Bank Offerings

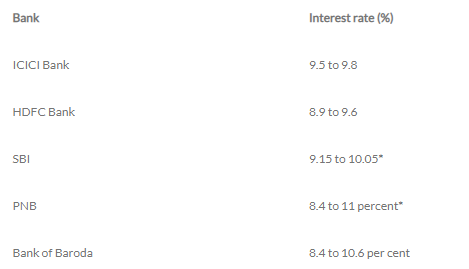

Let’s explore the interest rate offerings of prominent banks to gain insights into their varying structures and implications.

ICICI Bank: Tailored Rates for Varied Borrowing Scenarios

ICICI Bank caters to diverse borrowing scenarios by offering tailored interest rates. For loans ranging from ₹35 to 75 lakh, interest rates oscillate between 9.5 to 9.8 percent for salaried individuals and 9.65 percent to 9.95 percent for self-employed borrowers.

However, as the loan amount exceeds ₹75 lakh, a marginal increment in interest rates is observed. The rates fluctuate between 9.6 percent to 9.9 percent for salaried professionals and 9.75 percent to 10.05 percent for self-employed individuals.

HDFC Bank: Standard and Preferential Rates

HDFC Bank adopts a nuanced approach by offering standard and preferential interest rates. The standard interest rate falls within the range of 8.9 percent to 9.6 percent, while the preferential rate varies from 8.55 percent to 9.10 percent.

State Bank of India: Credit Score Dependency

State Bank of India (SBI) predicates its interest rates on the credit scores of borrowers. High-scoring individuals are granted loans at rates between 9.15 percent to 9.55 percent.

For credit scores ranging from 700-749, the interest rates witness a slight elevation to 9.35 to 9.75 percent. The rates further ascend to 9.45 to 9.85 percent for scores between 650 to 699. In cases of even lower scores, interest rates fluctuate between 9.65 to 10.05 percent.

PNB: Credit Score Sensitivity

Punjab National Bank (PNB) exhibits sensitivity to credit scores in its interest rate determinations. Scores exceeding 800 garner an interest rate of 8.40 percent for loans exceeding ₹30 lakh.

For scores of 750, the interest rate stabilizes at 9.45 percent regardless of the loan amount. Individuals with scores ranging from 700-749 face an upward adjustment to 9.90 percent, while those with lower scores encounter a higher rate of 11 percent.

Bank of Baroda: A Fixed Interest Rate Spectrum

Bank of Baroda adheres to a fixed interest rate spectrum across all borrower categories. The rates span from 8.4 percent to 10.6 percent, providing borrowers with a structured framework for loan evaluation and comparison.

Conclusion

Navigating the labyrinth of home loan interest rates necessitates a comprehensive understanding of the offerings presented by various financial institutions. By leveraging this knowledge, prospective homeowners can make informed decisions aligned with their financial goals and aspirations.